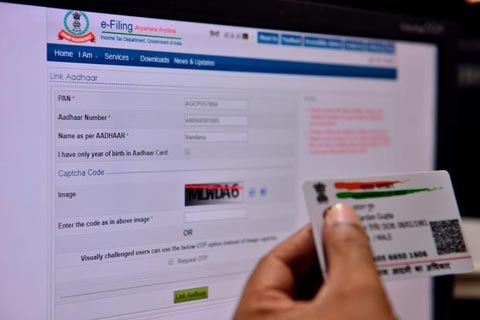

Aadhar based e-PAN facility for tax payers

Posted on: 30/Jun/2018 6:06:38 PM

On Friday, the tax department has launched e-PAN facility in real time basis. This move is likely to bring down the required communication between taxpayers and the department for generating permanent account number with no kind of commotion.

This is a free facility with which you can easily sign into the portal of income tax for generating e-PAN. For all individual tax payers, this system will be made available. And it is not for Hindu undivided families, trust or companies or firms. This will be available for a stipulated time period on first come first serve basis for Aadhar holders.

For this, there is no need for any document submission. The Aadhar details will be used for producing the e-PAN. Hence the details must be ensured so that the e-KYC can be possible with Aadhar data itself.

Upon making e-KYC with Aadhar details, the initiation of e-PAN will be possible. For this, a scanned copy of signature on a white paper is essential. This should be submitted with the required specification mentioned on income tax site. Once the application is filed, an acknowledgement number of 15 digit will be generated and shared to the registered mobile number and mail id.

Speaking about this, the partner and leader, personal tax of a consulting firm says the enhanced technology usage is to be thanked. Thanks for adopting it. It is going to be a paperless and convenient method. In the coming days, a lot of such initiatives can be expected.