Gold Monetization Scheme, Gold Sovereign Bond and gold coin scheme released

Posted on: 06/Nov/2015 12:55:16 PM

Prime Minister Narendra Modi on Thursday launched Gold Monetization Scheme (GMS), Gold Sovereign Bond Scheme and the Gold Coin and Bullion Scheme. This scheme is aimed at tapping part of an estimated 20,000 tonnes of idle gold lying in family lockers and temples into the banking system.

Under Gold Monetization Scheme depositors will get a 2.25 per cent interest rate for medium-term deposits and 2.5 per cent for long-term ones. Principal and interest under the scheme will be denominated in gold. The tenure for short-term deposits will be one to three years, medium-term will be five to seven years and long-term tenure will be 12-15 years

The Gold Sovereign Bond will be issued by the Reserve Bank of India (RBI) on behalf of the government with an interest rate of 2.75%. The bonds will be sold through banks and designated post offices. The first tranche is to close on November 20 and the bonds will be issued on November 26. The price for a gram of gold is fixed at Rs 2,684.

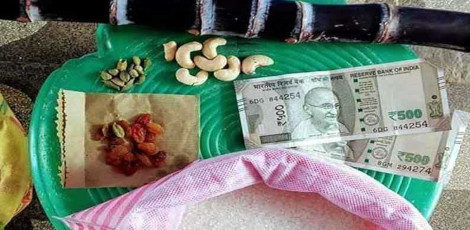

The PM also launched Ashok Chakra-embossed gold coins of five, 10 and 20g, to be sold by government-owned MMTC Ltd through its dealer network and outlets. These coins will come from the Government of India mint.