Lock facility for SBI net-banking

Posted on: 27/Sep/2019 5:18:07 PM

The country�s premier public sector bank, State Bank of India (SBI), has introduced a safety feature, preventing money theft through net-banking.

Subsequent to the recent trend of increasing thefts with the online banking system, SBI has introduced this new facility.

Thus, there is a facility to �lock� and �unlock� the internet (online) banking facility with State Bank of India.

SBI has explained regarding this new facility:

�With the main objective of keeping the bank savings accounts safe, from now, the internet banking facility can be locked or unlocked.

This facility has been inserted in the front page of the facility for internet banking. However, this facility applied only to retail customers. It is not yet introduced for corporate clients.

Only one aspect is important to use this facility. That is the �profile password�. The customers need to use this profile password. One must remember this profile password in order to use this facility.

Another important aspect is that the log-in password and the profile password are 2 different things. So, in order to manage the savings account or changing the cellphone number, etc., one needs to use the profile password.

In case the profile password is forgotten, you have to reset the before locking the net-banking facility.

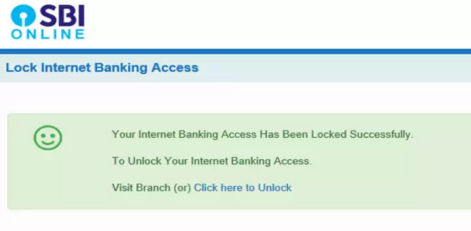

Here is the procedure for locking or unlocking the net-banking facility:

- Visit the SBI net banking page: https://www.onlinesbi.com/.

- Space has been made for the locking/unlocking facility just below the log-in. Click this.

- The personal page will appear.

- Click the �drop-down arrow� and select the lock or unlock option.

- Now, you can enter the username, bank savings account number, and the letter shown on the screen.

- Information will appear. Read this and press ok.

- You will get the OTP - one-time password (on cell or email). Enter the same and lock your net-banking account.

- Once the account is locked, no transactions can be carried out!

- So, once the monthly required transaction on the net-banking is completed, this can be locked. So, no theft/cheating can be done

- Of course, when you want to use again, you have to unlock!