Special dispensation for small merchants

Posted on: 23/Nov/2016 12:16:33 PM

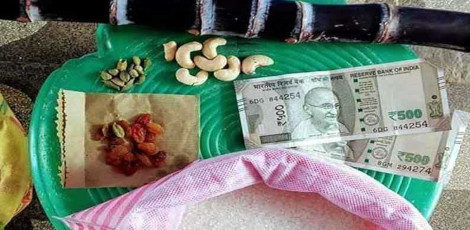

The Reserve Bank of India, RBI, today introduced special dispensation for small merchants and doubled the limit of semi-closed Prepaid Payment Instruments, or PPIs, Rs. 20,000 to facilitate digital transactions.

In an official statement, the RBI said, A special dispensation has now been enabled for small merchants whereby the issuers can issue PPIs to such merchants. While balance in such PPIs cannot exceed Rs. 20,000 at any point of time, the merchants can transfer funds from such PPIs to their own linked bank accounts up to Rs. 50,000 per month, without any limit per transaction. Merchants only need to provide a self-declaration in respect of their status and details of their bank accounts.

The limit of semi-closed PPIs issued with minimum details has been enhanced to Rs. 20,000 from the existing Rs. 10,000. The total value of reloads during any given month has also been enhanced to Rs. 20,000. Full KYC PPIs with balance up to Rs. 1,00,000 can continue to be made available by authorised PPI issuers.