Central Budget presentation today: Prospects of increase in IT exemption limit

Posted on: 01/Feb/2018 10:17:46 AM

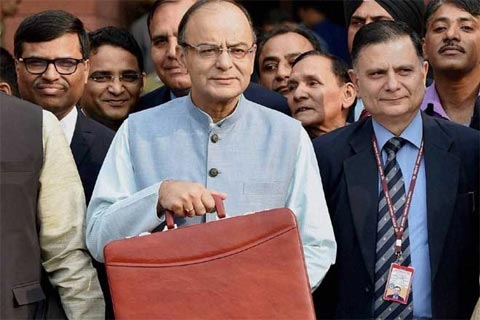

The central finance minister Arun Jaitley will be presenting the budget today in the parliament. As this would be the last budget to be presented by BJP in their 5-year term as the government, it has led to high liberal expectations from various cadres � salary income class, institutions, and consumers.

In a survey conducted by Ernest Young, around 69% people have expressed confidence that the upper limit for Income Tax exemption would be increased.

It is gathered that the IT exemption limit is likely to be increased from the present Rs. 2.5 Lakhs per annum to Rs. 3 Lakhs per annum. A survey confirms that around 75 Lakh persons will benefit from this concession.

Presently, for the annual income group Rs. 3 Lakhs to Rs. 5 Lakhs, 5% IT is charged. This to be increased to the bracket of Rs. 3 Lakhs to Rs. 6 Lakhs.

For the annual income group in the bracket Rs. 6-12 Lakhs, 20% IT may be collected. For the bracket above the annual income of Rs. 12 Lakhs, 30% IT may be collected. The IT consultant expert stated that those who are earning more than Rs. 6 Lakhs per annum will get a concession of Rs. 15000 per year.

The middle-class cadre of the economy, especially those who are in the monthly salaried income cadre, the increase in IT exemption limit will bring a token relief. The central government has planned to improve the road transportation system throughout the country under the scheme �Bharatmala�.On this aspect, it is gathered that additional funds will be allotted for the Ministry of Highways.

During the 2016 budget, it had been announced that the Corporate Tax will be gradually reduced from 30% to 25%. Accordingly, in the current financial year budget, the corporate tax was reduced to 29% for the organisations with a turnover of less than Rs. 5 Crores. Now, this is expected to be reduced further in this budget.

In the Stock Exchange trading, the capital tax exemption period limit may be increased from 1 year to 3 years.

The central government is quite keen on the avenues to create fresh jobs. It is expected that the policy regarding job opportunities, especially in the labour-intensive sectors.

The central government has already announced that it will increase the income of the farmers by the double by the year 2022. On this accord, there are prospects of higher fund allotment for the rural development and welfare department.

It is also gathered that some important announcement is likely to be made giving priority to the agricultural sector, small/micro/medium industry sector, infrastructure development, and the scheme of �Housing for All�.