Status of Income Tax concessions after the budget on various avenues!

Posted on: 12/Feb/2020 6:09:05 PM

In the ensuing financial year, the Income Tax exemption for certain categories continue! It is left to the individuals to decide on the savings attempt on filing Income Tax returns. It is worth noting that many existing tax concessions have been removed! Some categories continue. So, the individuals can ascertain all related data and then make a decision.

Post Office Savings Account

The Income Tax Concessions for the Post Office Savings account continues. A single individual P. O. Savings Account holder can get a tax concession of up to Rs. 3500 and a joint account can provide tax savings up to Rs. 7000. This concession can be availed from the total earnings of the year.

Gratuity

Gratuity is given to employees of the private sector industries who have more than 5 years of service. During one’s lifetime, an individual can get a tax concession of up to Rs. 20 Lakhs on earning gratuity. For government employees, there is no upper limit in this regard. This category of concession continues in this financial year.

Life Insurance

The concession which was given for LIC premium payment under section 80(C) has been withdrawn from this financial year. However, Income Tax concession can be availed at the time of maturity of this LIC investment.

Provident Fund

For the Provident Fund of the employees deposited by the companies, Income Tax concession can be availed to a maximum of Rs. 7.5 Lakhs per year. In a similar vein, under NPS (National Pension Scheme), Income Tax concession can be availed on the amount deposited by the employers. Only those with an annual income of more than Rs. 50 Lakhs will need to pay IT.

PF Interest

The Income Tax concession is given to the interest earned on the PF account continues. However, if the interest rate is more than 9.5%, Income Tax has to be paid.

PPF Account

Income Tax concession CANNOT be claimed on the Public Provident amounts deposited. However, IT concessions can be availed on the interest for this amount. Similarly, Income Tax concession can be availed after maturity.

‘Selvamagal’ Saving Scheme

The Income Tax concession is given to the interest in the investment under ‘Sukanya Smriti Yojana, or ‘Selvamagal Semippu Thittam’ continue! IT concessions are available for refund as well. Howowever, there are no Income Tax Concessions for the investment made.

National Pension Scheme (NPS)

The Income Tax concession on NPS continues. Income Tax concessions can be availed for the amounts withdrawn in-between as well!

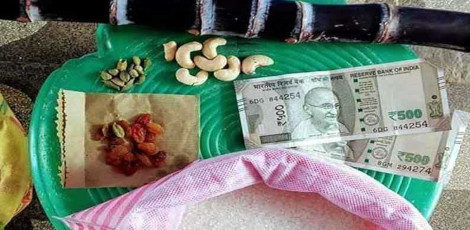

Company gifts/presents

Income Tax concessions can be availed on the gifts/presents given by the employer. This concession can be availed up to a maximum gift amount of Rs. 5000.

Pension

Income Tax concession on the Pension amount also continues after considering the ‘Pension Commutation.

Encashment of balance leave period after service

A maximum Income Tax concession of up to Rs. 3 Lakhs can be availed while encashing the balance left on hand before retirement.

Voluntary Retirement

The Income Tax Concession of up to a maximum of Rs. 5 Lakhs while taking voluntary retirement is continued.