Equitas SFB Limited Gold Loans helping to meet customers financial requirements

Posted on: 01/Jul/2020 9:27:30 AM

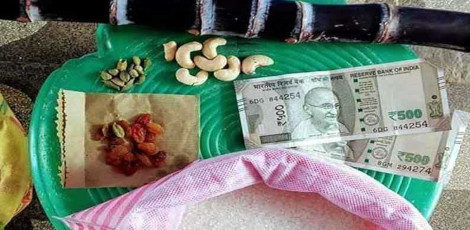

Equitas Small Finance Bank Limited (The Bank), the largest Small Finance Bank ("SFB") in India in terms of a number of banking outlets as of March 31, 2019 (Source: CRISIL Report), is offering a gold loan to customers to meet their cash requirements.

With an aim to provide the best service to the customers, the gold loan is processed through easy documentation and instant cash. NACH repayment is also available for this product.

Loans secured by gold jewelry of customers, repayable by monthly installments or interest modes scheme rather than on a one-time repayment basis only. The average ticket size of loans is in the range of Rs. 30,000 to Rs. 4 million. The maximum loan tenure for any scheme is 24 months.

Customers can avail of this loan by visiting the nearest branch of Equitas SFB. Customers availing gold loans can repay through EMIs and Equitas SFB also offers an overdraft facility in this product.

Mr. Murali Vaidyanathan, President & Country Head - Branch Banking, Liabilities, Product & Wealth, Equitas Small Finance Bank Limited, said, �Equitas SFB aims to offer best in class products for its existing as well as prospective customers. We believe in India gold loan is one of the segments in loan products which is likely to witness growth in the coming times. It generally helps the customers to meet their urgent financial requirements. The gold loan market is further expected to grow at a CAGR of approximately 10% over the next three years to Rs. 3.8 trillion by Fiscal 2022. Stable demand and initiatives to increase awareness are expected to help the industry grow moderately along with geographic diversification and rising interest from the northern, western, and eastern regions.�

Equitas Small Finance Bank Limited is the largest SFB in India in terms of number of banking outlets, and the second-largest SFB in India in terms of assets under management and total deposits in Fiscal 2019. (Source: CRISIL Report). As of September 30, 2019, its distribution channels comprised 853 Banking Outlets and 322 ATMs across 15 states and union territories in India. Its focus customer segments include individuals with limited access to formal financing channels on account of their informal, variable, and cash-based income profile. It offers a range of financial products and services that address the specific requirements of these customer segments by taking into account their income profile, nature of the business, and type of security available. Its asset products are suited to a range of customers with varying profiles. These include the provision of small business loans comprising loans against property, housing loans, and agriculture loans to micro-entrepreneurs, microfinance to joint liability groups predominantly comprising women, used and new commercial vehicle loans to drivers, and micro-entrepreneurs typically engaged in logistics, MSE loans to proprietorships, and corporate loans. On the liability side, its target customers comprise mass and mass-a-affluent individuals to whom the Bank offers current accounts, salary accounts, savings accounts, and a variety of deposit accounts. In addition, it also provides non-credit offerings comprising ATM-cum-debit cards, third party insurance, mutual fund products, and issuance of FASTags.