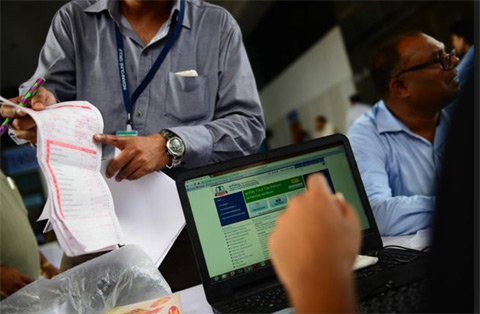

Simple online procedure for tax file returning

Posted on: 29/Jul/2017 11:57:20 AM

Here comes the time to file tax. If you are rushing to get your tax filed before the deadline which is on 31st July, take a look at the below steps for easy and simple online tax filing.

It is important to note that if you are a filer for the first time, you should firstly get registered on www.incometaxindiaefiling.gov.in first.

First of all, visit the website and log into your account. You have 2 options. One is View Returns or Forms, and the other is Quick e-file ITR.

Pick the right ITR form as you have various types in the same. For instance, there are ITR 4, ITR 3 and so on. ITR 4 is for people who get income out of proprietary business or profession, whereas ITR 3 is for those who get a profit share out of Partnership Company.

Cross check the pre-filled personal details or feed the details in it. Enter details of your earnings and tax deductions under chapter VI-A and the other kinds of tax deductions from employer or others.

When tax has to be paid, you can do an online payment and get Challan Identification Number and counterfoil.

Fill all the ITR forms with all the challan details, CIN, payment details, and bank details through which you make payments.

Click on to submit all the returns or the XML file has to be uploaded.

Get the ITR-V form printed for verification. Or using your PAN card or Aadhar card, you can e-verify. If you are set to get the ITR-V form printed and mailed to the Income Tax office, make sure to do it within 120 days of getting the e-filing done.

For this IT return, you will receive an acknowledgement to your registered mail id.

When the return has digital signature, it indicates completion of filing process at the time of receiving acknowledgement notification.