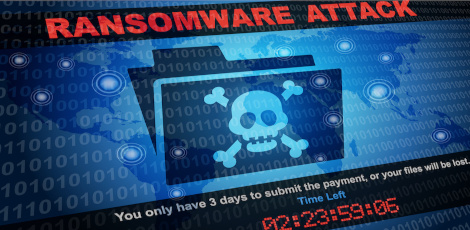

Ransomware attacks on many banks in India are now causing issues!!

Posted on: 02/Aug/2024 9:30:06 AM

The payment systems across 300 small Indian local banks have shut down now. The reason for this is due to a ransomware attack on the technology service provider. This was brought out by news agency Reuters.

It must be noted that in India C-Edge Technologies has been providing banking technology systems for small local banks. It seemed that RBI, the country`s banking and payment system regulator did not respond to the Reuters request for comment.

On Wednesday, NPCI or National Payment Corporation of India mentioned that it temporarily isolated C-Edge Technologies from accessing the retail payment system operated by NPCI. It is known that NPCI is an authority that oversees payment systems. The NPCI has clearly pointed out that the customers of small banks serviced by C-Edge Technologies would not be able to access the payment systems during the period of isolation.

To avoid any wider impact, about 3000 small banks have been isolated now from India`s broader payment network. This was as per some sources. It was explained by one of the sources that most of these were small banks and only about 0.5% of Indian payment system volumes would get affected.

It must be remembered that there are about 1500 cooperative and regional banks across India and these have operations outside the big cities. Now, NPCI is conducting an audit to avoid the spread of the attack. This was as per the second source. It was clear that RBI and cyber officers in India have warned various banks across the country about possible cyber attacks in the past few weeks.