IMPORTANT!! RBI would take action against banks if their ATMs remained out of cash for 10 hours!!

Posted on: 11/Aug/2021 9:32:29 AM

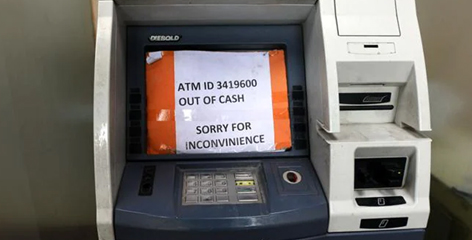

The latest news is that Reserve Bank of India or RBI would take strict action against those banks if the customers could not get cash from the ATMs. Failure to replenish currency notes on time at the ATMs would not be considered lightly anymore and banks would be penalized by RBI.

From 1st of October onwards, RBI would begin imposing penalty on the banks if ATMs belonging to the banks remain out-of-cash for a period of 10 hours in a month.

It was mentioned in the circular from RBI that the scheme of penalty for non-replenishment of ATMs has been formulated to make sure that enough cash is available for the public. Fact is that public have been facing issues in withdrawing cash from the bank ATMs due to lack of cash availability.

It must be noted that RBI has a mandate to issue bank notes and banks are fulfilling this mandate by dispensing banknotes to the people through their wide network of branches plus through their ATMs. It is learnt that RBI undertook review of downtime of ATMs due to cash outs. Truth is that the operations of ATMs were affected by cash outs and this created avoidable inconvenience to the public.

To monitor the cash availability at the ATMs, banks and White Label ATM operators or WLAOS would strengthen their systems and ensure timely cash replenishment to avoid cash outs at the ATMs.

It was clearly stated by RBI circular that any non compliance would be considered seriously and would attract monetary penalty as stipulated in the Scheme of Penalty for non-replenishment of ATMs. This important Scheme would come into effect from 1st of October 2021.

Information collected is that cash out at any ATM for more than 10 hours of time would attract a flat penalty of Rs 10000. The penalty would be charged to the bank (meeting the cash requirement of particular WLA) incase of White Label ATMS or WLAs. It was further said that the bank at its discretion could recover the penalty from WLA operator. In India as of end of June month data, there were 213766 ATMs of different banks.